This article is part of a special series combining important perspectives from our BRICS country partner sites chinadialogue and India Climate Dialogue on the New Development Bank. To access the full report, click here

Since the New Development Bank (NDB) began operations in February 2016, the multilateral financial institution created by the governments of the BRICS countries (Brazil, Russia, India, China, and South Africa) has approved more than US$1.5 billion in finance for infrastructure projects in member countries.

However, on the eve of the 9th BRICS summit, which will take place from September 3–5 in Xiamen, South-Eastern China, the NDB has still not clearly disclosed which projects will receive funding, much less held any public consultations with communities that may be impacted by them. Public consultations are a common practice among other multilateral banks.

The absence of an official channel for dialogue with the bank, low levels of transparency and clarity on its social and environmental policies, and the precedents this sets as the bank looks to expand and incorporate new members are a concern for non-governmental and civil society organisations.

“There is no transparency with regard to how the processes of approving projects take place. Up to this point, the bank has not yet disclosed the impact reports for the projects that are under analysis,” claims Paulo Esteves, director of BRICS Policy Centre research group based at the Pontifical Catholic University (PUC) of Rio de Janeiro.

Insufficient dialogue

Senior bank staff, including vice-presidents representing Brazil and Russia, have held conversations with civil society groups. But these occurred behind closed doors, according to Caio Borges, an attorney with Brazilian human rights NGO Conectas.

“Contact with the bank occurs in informal conversations alongside the bank’s annual meetings and the BRICS summits,” said Borges, who has participated in some of these conversations. “But at the Xiamen summit, there are no meetings scheduled between civil society and the bank,” he told Diálogo Chino.

According to Borges, civil society organisation The Coalition for Human Rights in Development has demanded an official meeting with the NDB in order for the bank to clarify the basic development principles in supports. China-led multilateral lender the Asian Investment in Infrastructure Bank (AIIB) provides this opportunity for civil society groups on the occasion of its annual general meetings.

“The concept of sustainable infrastructure used by the NDB in its general strategy is very broad and vague, and lacks definition,” says Borges, who travelled to India at the end of August to participate in a working group on the concept of sustainable infrastructure.

Bright start

Until now, most of the project financing approved by the NDB has focused on renewable energy, such as wind and solar generation projects and small hydroelectric plants. The NDB signed loan agreements with development banks of its member countries, as part of a process known as on-lending.

Despite these “green” first loans, critics argue that there is no policy framework in place to ensure that the support of sustainable projects continues as the bank scales up its operations.

One of the NDB’s policies involves relying on regulatory systems in member countries for the approval of projects and the undertaking of environmental and social impact assessments. These vary according to social and environmental standards in each country.

In Brazil, for example, the job of approving a US$300 million loan from the NDB falls to the National Economic and Social Development Bank (BNDES). Leonardo Botelho Ferreira, head of the international cooperation department at BNDES, told Diálogo Chino that the NDB vetted BNDES’ rules before disbursing funds, which he said would be best directed towards wind farm projects already part of the national bank’s portfolio.

“The NDB carried out due diligence at BNDES and of the rules of Brazilian environmental agencies that apply to the bank. The NDB had access to how the licensing process is done and monitoring of licences,” Botelho explained. However, he added that the NDB should also conduct internal analyses on projects. According to Botelho, if bureaucratic procedures enabling the approval of the loan go smoothly, BNDES will be able to request disbursement from the NDB by the end of this year.

The use of national systems to analyse development projects is also characteristic of other multilateral banks such as the World Bank and the Inter-American Development Bank.

So what’s the problem with working with the domestic assessment systems?

According to Esteves, there is no direct monitoring of projects: “A due diligence is done before, but the process is not followed. We can have a good regulatory framework, but not necessarily an effective system,” he said.

New members, lower standards?

Observers are also concerned about the environmental and social safeguards that will apply to potential new members of the NDB.

“We may think that the five countries receiving loans from the NDB have sufficiently strong and consistent national systems, which may not necessarily be true. But what happens when the bank lends resources to other countries that do not have such efficient systems?” Esteves asked.

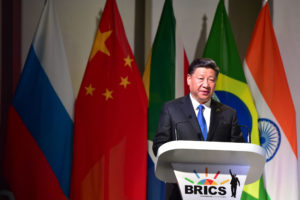

According to Borges, the NDB will not feature high on the agenda at the Xiamen BRICS summit and nor will it be a priority at a parallel BRICS event, which brings together representatives from civil society.

This is because the NDB tries to retain its autonomy from the BRICS forum and the political and economic interests of member countries that can dominate meetings.

“The bank cannot be at the mercy of the governments of [member] countries,” Esteves said, adding that it depends on being evaluated independently in order to acquire resources at a lower cost and to try to compete on an equal footing with other multilateral banks.

“It would not survive with only the resources provided by founding countries,” he said.

Diálogo Chino requested comment from the NDB for this article on the topic of its engagement with civil society. The bank advised that it would be unable to respond by the time of publication.

![A woman pumps up water from a tubewell in West Bengal despite the red cross that signifies that there is an unacceptable level of arsenic in the water [image by Dilip Banerjee]](https://dialogue.earth/content/uploads/2017/09/Woman-at-tubewell-West-Bengal-Image-by-Dilip-Banerjee-1-300x206.jpg)