Aided by close control and stimulus from government, China has seen huge success in its campaign to reduce industrial energy inefficiency. What is responsible for recent gains, and what can emerging economies such as Brazil learn from the mechanisms China used?

China’s breakneck economic growth since the turn of the century has been matched by impressive progress on energy efficiency, leading it to become “the world heavyweight” in this division, according to the International Energy Agency (IEA). Between 2000 and 2015, energy efficiency improved by 30%, with industry, both China’s main driver of economic growth and the biggest consumer of energy, recording the largest improvements. Similar to China, Brazil’s economy also consistently recorded high, albeit lower, annual growth rates over the same period until it entered recession in 2014, yet energy efficiency has flatlined.

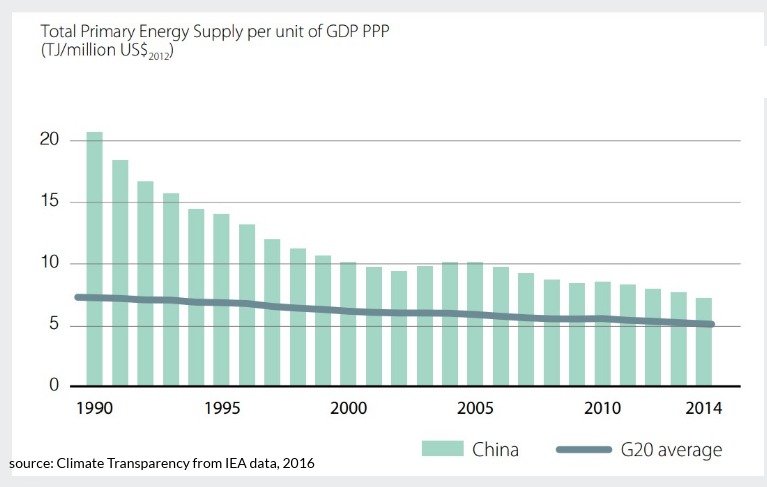

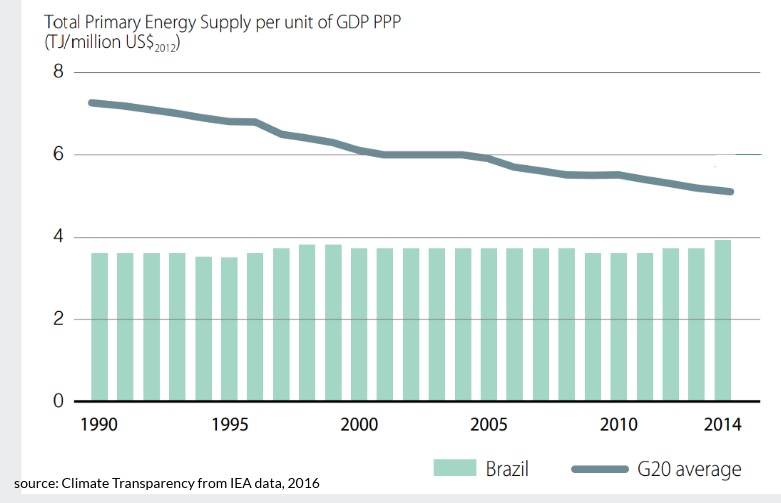

Economies tend to use more energy as they grow. However, reducing the energy intensity of economy – calculated as the amount of energy used per million US dollars of GDP generated – can lead to an eventual decoupling of energy consumption from growth. In Brazil, the energy intensity of the economy has remained conspicuously unchanged since 1990, when Brazil used less than 4 terajoules of energy per US$1 million of GDP.

The research group Climate Transparency rates Brazil’s recent developments (2009-2014) as “very poor”. In contrast, and thanks to a series of centrally planned programmes designed to optimise the energy efficiency of the Chinese economy first launched in the 1990s, China has witnessed steady improvements in its energy performance, with recent developments rated “very good”. Almost 30 years ago, China required over 20 TJ/US$1 million GDP. Today, the figure stands at around a third of that 1990 high.

Why did these two “two emerging” economies have such different experiences of improving energy efficiency as they grew? A closer examination of consumption patterns in both countries, and the policies that influence them, hold some important clues.

Industry is key

The industrial sector in China accounts for around 70% of total end-user energy consumption and, as such, is critical in climate mitigation, since around 85% of this energy is generated by non-renewable sources. As in many developing nations, combining measures to save energy and boost efficiency has been a challenge. But in the 1980’s in China, where energy use was particularly high sectors like steel, oil refining, coking and chemicals, the government began to build a system to improve energy efficiency that yielded notable successes.

“China has achieved the most significant successes in increasing energy efficiency,”

Both the IEA and China’s top planning body the National Development and Reform Commission (NDRC), estimate that between 1990 and 2013 the G20 nations, which account for 80% of primary energy consumption worldwide, saw energy intensity– drop by around 1.5% a year. In Brazil, industry is followed closely by residential consumers at 28% (2016), according to the 2017 Statistical Annual of Electrical Energy, published by Brazil’s Energy Research Company’s (EPE), the government’s planning and research arm. Most energy saving initiatives have focused on domestic consumption.

With minimal growth returning to Brazil after more than two years of recession that led to an aggregate 8% contraction of the economy, greater industrial energy consumption looks likely to follow, especially in the industrial southeast, which accounted for the largest regional drop in energy use. Nationally, consumption grew 1.3% last year following two consecutive years of decreases; of 6.2% in 2015 and 2.5% in 2016.

A global oversupply in energy-intensive sectors such as steel has meant tumbling prices and left productive sectors unprofitable; factories have fallen idle. But as it recovers, Brazil could look to the example given by China, which “has achieved the most significant successes in increasing energy efficiency”, according to Dai Yande, head of the NDRC’s Energy Research Institute (ERI), and also begun to tackle industrial overcapacity.

But while there are lessons in China’s success, many of these are closely linked to the country’s unique political and governance systems. Applied to an ambitious programme of industrial upgrading, which prioritised the development of higher value-added sectors and shifted investment away from energy-intensive heavy industries, it reveals where gains in energy efficiency can be achieved.

China: From “managing” to “promoting”

China’s system for managing energy saving has gone through two stages, and is currently shifting to a third, according to ERI.

The first stage was from 1981 to 1997. At the beginning of this period, China produced only one-seventh of the energy it does today. Government energy saving campaigns were intended to relieve energy shortages by planning for all aspects – large and small – of energy-saving in businesses. This period saw the establishment of mechanisms for assigning and auditing energy quotas for state-owned companies, the main consumers of energy at that time. These were driven by government orders which placed strict limits on energy use by businesses. Energy use was brought under control, and where possible reduced.

The second phase began in 1997, when the Energy Conservation Law came into effect. This made the state responsible for setting energy efficiency standards, with new companies only allowed to start work if those standards were met. The government no longer only ordered state-owned firms to take certain energy-saving steps – it became a legal responsibility for all types of companies to save energy. The Central Committee – the Chinese Communist Party’s top leadership body – approved the conservation of resources as a basic national policy.

The Administrative Measures for Energy Conservation in Key Energy Consumers issued in 1999 gave more detailed rules applying to firms using more than the equivalent of 10,000 tonnes of standard coal of energy per year. For example, an energy management post had to be created, responsible for overseeing the company’s energy use. Only engineers with three years of experience in energy-saving work were qualified to hold this position.

The Chinese government also started to offer substantial subsidies to encourage energy-saving measures, reducing the economic costs to companies and so encouraging the use of energy-saving equipment and technology. By this point, a sound system for managing energy-saving in Chinese companies had taken shape.

The third, most recent phase of energy saving arrived with the new environmental focuses of the 11th and 12th Five Year Plans (FYP) for development that covered the periods of 2006-2011 and 20011-2015, respectively. The 13th FYP period beginning 2016 continues their legacy with a special ‘Action Plan for Energy Conservation’ jointly issued by 12 ministries including NDRC, the Ministry of Industry and Information Technology (MIIT), the Ministry of Science and Technology (MOST), and the Ministry of Finance (MOF).

Toughening national energy-saving targets

China’s national-level energy consumption targets got steadily more ambitious as work on industrial energy-saving intensified.

In 2006, a target was set of reducing energy intensity by 20% over the period of the 11th FYP, which stressed the need for a more sustainable model of development, in contrast to the “getting rich first” rapid, often highly unequal version, which had dominated thinking previously. This was the first time China had set a binding energy-intensity reduction target in its national quinquennial plans and marked the start of energy-intensity controls. Wei Han, Program Officer for Industry Program at Energy Foundation China, said that industry insiders regarded this target as the government sending a powerful signal on promoting energy saving and emissions reductions, mitigating climate change and promoting green economic growth. The target translated into an estimated annual emissions reduction of over 1.5 billion tonnes of carbon dioxide. However, it also attracted controversy.

In desperate late rush to meet the targets, local authorities reportedly cut power supplies to factories, traffic lights, and even hospitals. The episode also served to demonstrate how target-responsibility systems increasingly held local officials to account for their performance. In the end, China achieved an energy intensity reduction over the 11th FYP of less than one percentage point shy of the goal.

Energy intensity is a measure of decoupling, rather than a curb on growth per se – under conditions of fast economic growth an intensity target will not prevent overall energy consumption continuing to expand. And as China’s baseline energy consumption is so large, controlling the intensity of growth cannot stop large increases in energy consumption. Therefore, in 2016 the Chinese government added a total energy consumption target to existing intensity targets, saying that “2020 total energy consumption will be within 5 billion tonnes of coal equivalent.”

“In desperate late rush to meet the targets, local authorities reportedly cut power supplies to factories, traffic lights – even hospitals.”

Some industry figures, however, said the target was not radical enough. But the presence of an energy consumption ceiling became a major factor in local government decision making and seemed to further encourage a transition towards upgrading to sectors that produce more economic output for less energy input, namely those of higher technology manufactures.

The energy police

For “hard limits” to be more than empty words, you need “hard enforcement.” Alongside internal company employees with responsibility for energy-saving, the government also set up a system for oversight of energy-saving, with provincial and city governments, and even some counties, having energy efficiency oversight bodies and teams.

Wei Han explained that the systems set up over the 11th and 12th Five Year Plan periods: measures to close small, inefficient plants; the Top 1,000 Enterprises Program for industrial energy efficiency, which fostered significant technological upgrades in large enterprises; and the Ten Key Energy Conservation Projects, which included green lighting projects and combined heat and power (cogeneration) – are now starting to take shape. Today, officials are responsible for checking on the energy-saving performance of companies, looking for out-of-date equipment that should be replaced, and whether quotas have been met.

The industry view is that the system does promote the implementation of energy-saving, environmental protection and green development strategies and accelerates the upgrading and high-quality development of China’s industrial sector. It will also do a great deal to foster development in China’s energy-saving and environmental-protection technologies sector.

The key role of subsidies in energy saving

During the 11th FYP period China invested a total of 846.6 billion yuan (US$135 billion) in energy-savings and emissions-reductions. Government subsidies have been key to promoting energy efficiency, as 149.7 yuan (US$23.7 billion) of this total came from central government. Total investment increased 2.4 times during the 12th FYP to over 2,000 billion yuan (US$317 billion), with central government investment approaching 220 billion yuan (US$34 billion), primarily in the form of subsidies for energy-saving improvements.

For example, in Shanghai in 2017 industrial firms received 600 yuan (US$95) in subsidies for every tonne of coal equivalent saved per year (up to 5 million yuan, and up to 30% of total project cost). Strong financial subsidies from different levels of government played a key role as “seed capital” in ensuring the energy-saving targets set in the 11th and 12th FYPs were met.

The Ministry of Finance and NDRC also ran comprehensive trials of energy-saving and emissions-reduction policies in which 30 trial cities were given annual funding of between 400 and 600 million yuan (US$65-95 million) for a three-year period, to fund innovation in low-carbon industries, clean transportation, green buildings and scaled use of renewable energy.

Brazil: Few incentives to save

In 2001, the Brazilian government imposed a period of electricity rationing as the hydropower-dependent nation experienced a severe drought. The experience helped put energy efficiency on the national agenda. Brazilians had been accustomed to an abundance of energy but were forced to reduce consumption, cut excesses, and eliminate waste. Until this time, efficiency concerns in industry had been closely linked to economic cost-benefit ratios, with companies weighing-up the level of investment needed in order to reduce consumption through inefficiency.

José Antônio Sorge, of energy company Ágora Energia believes that the lack of financing is a barrier to greater efficiency in Brazilian industry. The main source of credit for Brazilian companies is national development bank the National Social and Economic Development Bank (BNDES). “It is difficult to find sources of funding,” he said.

BNDES has a line of financing for renewable and energy efficiency projects called Green Energy. These projects received resources amounting to R$8.2 billion (US$2.5 billion) in 2017. However, aside from BNDES there are no other lines of credit. The lack of financing options means many projects fail to make it off the drawing board, Sorge says. He adds that diagnostic work to identify where energy is wasted and what actions are necessary to make improvements is insufficient.

According to André Lucena, professor of energy planning at the Federal University of Rio de Janeiro (COPPE-UFRJ), entrepreneurs considering capital opportunity costs (the cost of choosing to invest in some areas and forgoing others) and financing conditions, would find few incentives to save energy.

Greenpeace Brasil agrees. The cost of replacing inefficient technologies and the lack of knowledge among businesses of the long-term benefits this can bring are significant, the organisation wrote in a 2016 report entitled Energy [R]evolution. The report calls for energy efficiency auctions, the progressive elimination of obsolete technologies and more rigorous and binding standards for rational energy use by industry. Measures such as the incorporation of energy-efficient elements into the Brazilian civil construction code, for example, would also be welcome in this context, Lucena says.

A recent EPE recent study recognises the need for quicker movement towards rational energy use:

“There are still barriers that hinder the spread of energy efficiency, such as the low prioritisation of efficiency projects by companies and consumers, a lack of knowledge about efficiency potential and measures, a shortage of information and data, a lack of confidence on the real costs and benefits of efficiency actions, business models for making investments in efficiency, and resistance to change”.

Implementation in China

In China, some regions implemented policies on differentiated, punitive or tiered pricing of electricity. Energy-hungry firms failing to meet minimum standards paid punitive prices for their power, while tiered pricing was imposed on concrete and aluminium manufacturers, meaning costs went up as more power was used.

Wei Han told Diálogo Chino that the combined pressure from central and local government meant that more firms became subject to tougher policies. These efforts were the biggest worldwide, and the targets the most ambitious, she says.

Under this system, the government could decide what energy-saving technology to promote and what degree of subsidy support to provide. Interested firms could apply for the subsidy and, on approval, make the changes. The government would then check the implementation and disburse the subsidy.

From 2013, this method – characterised by government intervention and high subsidies – started to change. That year, the Central Committee decided at a plenary conference to “accelerate transformation of the government’s functions”: reducing as far as possible government micro-management and ensuring retained powers are exercised in a standardised and efficient manner.

With the government stepping back, market mechanisms will gradually come to the fore and drive China’s industrial energy-saving reforms.

The limitations of Chinese-style energy-saving

The Chinese government has given strong indications of its support for energy saving since the 1980s and Sorge believes strong public policies are equally critical in Brazil. He compares energy efficiency with microgeneration, especially rooftop solar panels, which has grown quickly in Brazil in recent years, mostly in homes, but increasingly in small industries and businesses thanks to the introduction of regulations incentivising installation in 2012 by the National Electrical Energy Agency (ANEEL).

But the level of support provided by the Chinese government also has drawbacks. Some warn the funding has supported energy-saving improvements for a number of steel, concrete and aluminium firms – but these are sectors where competition is fierce and government subsidies will undermine the role of market competition.

These policies can also be expensive to implement, as can oversight. For example, the government requires companies receiving subsidies to undergo third party audits. Yet during implementation local and provincial officials already carry out check-ups, as do the national energy-saving and financial authorities, and the National Audit Office. Some companies have complained of being audited or inspected as many as seven times.

Replicable success?

China’s energy-saving campaign has taken different routes to those promoting renewable energy and electric vehicles (or EVs), but the results have been the same. China’s top-down governance, government intervention in the economy and ability to pay out high subsidies have laid the foundations for a number of low-carbon transformations which have drawn worldwide attention.

As these sectors rapidly expand the government’s approvals and inspections processes, along with the expensive subsidies, become hard to sustain. After big initial strides forward, recent years have already seen the government cut various subsidies, and as industrial energy efficiency improves, continued reductions in industrial energy consumption will become increasingly difficult.

Though China’s gains may become increasingly marginal, other developing economies should take note, since they form part of an economy-wide transition that challenges industry by raising the costs of energy inefficiency, and striving to upgrade to higher value-added, and in many cases cleaner, sectors.

The early stages of Chinese industrial energy efficiency programmes may have picked the low-hanging fruit, but this still required strong stimulus and oversight from the government, which then became a decisive factor in industries’ thinking about energy consumption and waste. As the policies evolved to incorporate market mechanisms, they also promoted the idea that less energy-intensive industries might bring new benefits and opportunities.

If Brazil is to tread a few steps along the latter stages of China’s path, it must create the conditions for old, new and prospective industries to take on the energy efficiency challenge. In doing so, they will be encouraged to change the outmoded perception that investment in energy efficiency is not a price worth paying.